Table Of Content

Your loan limit depends on several factors besides your credit score such as your debt-to-income ratio, down payment amount and loan term. Most credit score services retrieve the FICO Score 8, which is a basic appraisal of your credit history. It doesn’t emphasize a particular loan type and serves as a baseline for general lending decisions.

Down payment and closing costs example

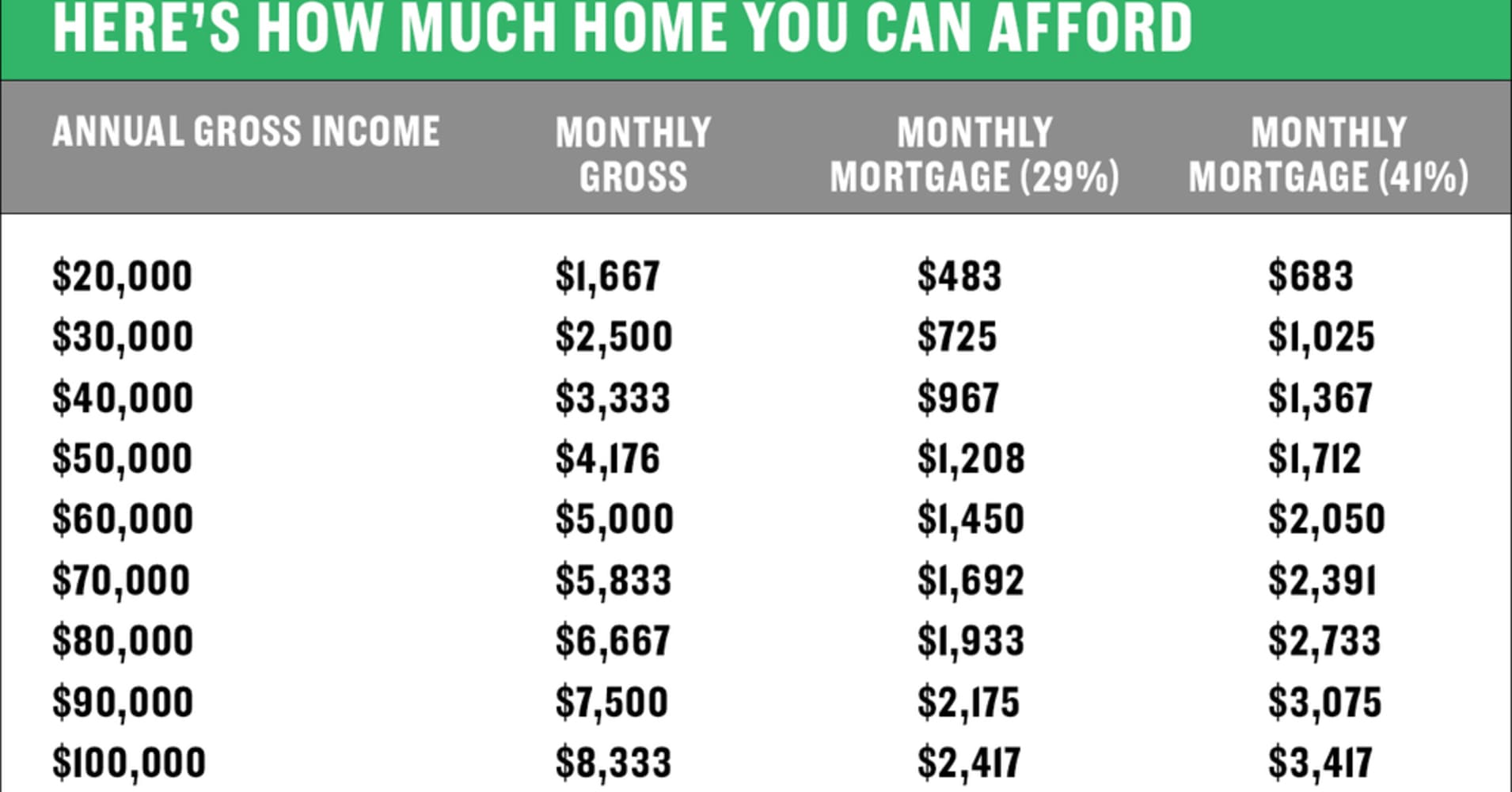

For the minimum down payment of 3% on a conventional loan or 3.5% for an FHA loan, $20,000 could be a sufficient down payment, depending on the price of the home you’re looking to buy. If you’re still wondering how much money you’ll need to buy a house, then you’ve come to the right place. Let’s discuss the details of the home-buying fees above, along with the ongoing costs of homeownership. The longer you can stay in a home, the easier it is to justify the expenses of closing costs and moving all your belongings — and the more equity you’ll be able to build. By using the 28 percent rule, your mortgage payments should add up to no more than 28 percent of $8,333, or $2,333 per month. Our goal is to give you the best advice to help you make smart personal finance decisions.

Save For A Down Payment

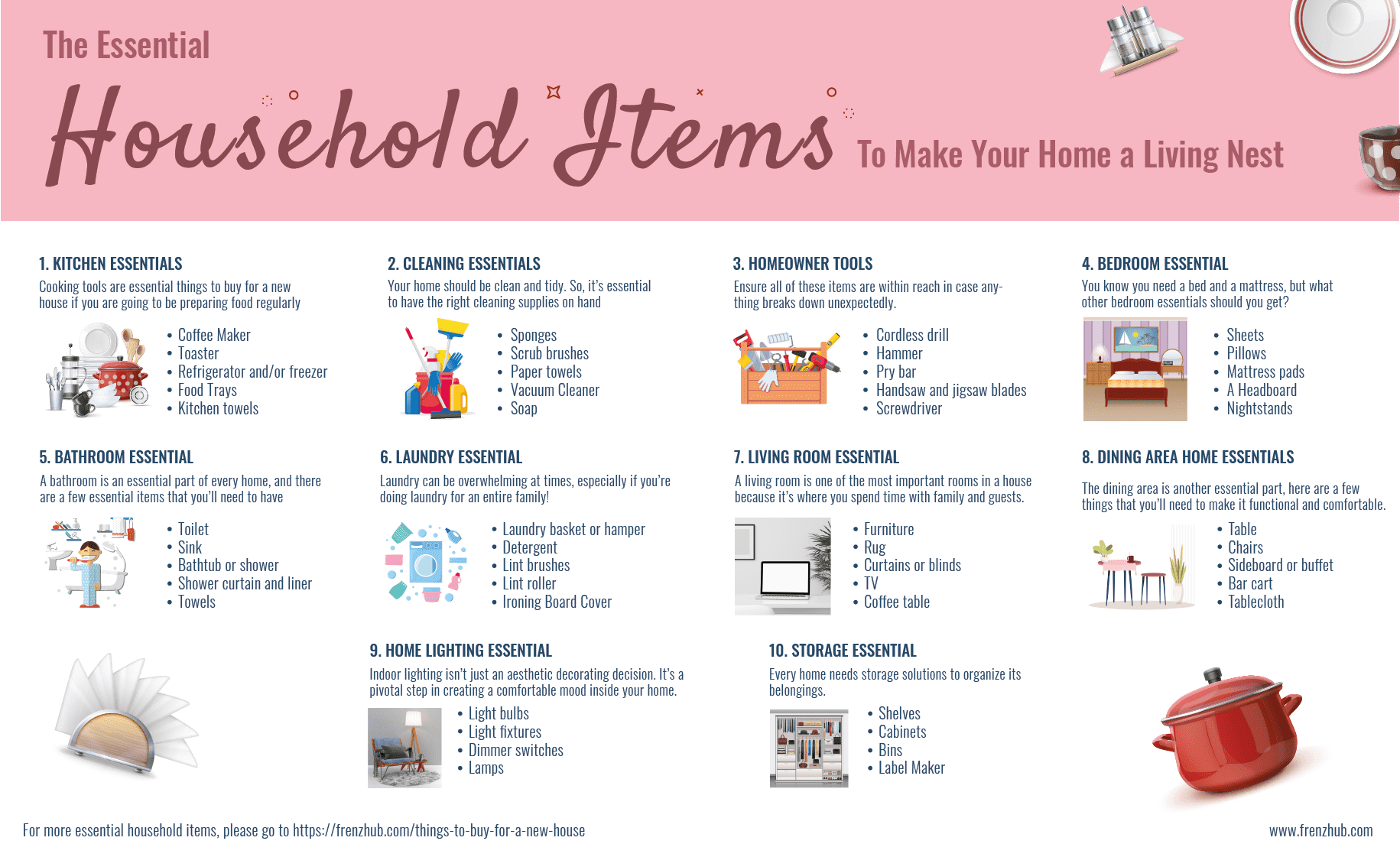

And on top of closing costs and prepaids, you’ll also want to earmark money for moving expenses, furniture, repairs, storage or any other costs you will encounter as you move into your new home. Where you live plays a major role in what you can spend on a house. For example, you’d be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco. If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs. Typically, your mortgage payment amount won't change over time (unless you have an adjustable-rate mortgage or you opt to make a change, like refinancing).

What’s the average down payment on a house for first-time home buyers?

Moving costs are higher during times of peak demand, such as summer weekends. When you're preapproved for any type of home loan, you will receive an official Loan Estimate that outlines all of the closing costs. This document will also make clear which costs you can shop around for and which are non-negotiable.

Using gift funds to cover your down payment

And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise. To buy a house, you’ll need enough money to cover the down payment and closing costs. These add up to at least 5 to 8 percent of the home’s purchase price. For example, if you’re purchasing a $300,000 home, plan on budgeting a minimum of $15,000 to $24,000. However, you may need as much as 22 to 25 percent if you want to avoid private mortgage insurance on a conventional loan. In addition to the down payment, you must prepare to cover your closing costs and moving expenses.

Buying A House In 2024: A Step-By-Step Guide - Bankrate.com

Buying A House In 2024: A Step-By-Step Guide.

Posted: Wed, 06 Mar 2024 08:00:00 GMT [source]

The average American homeowner spends about $270 a month on home utilities. The insurance protects you against covered losses and damage to your home. Let’s say your policy protects your home against fallen trees or branches. If a tree falls on your house, the insurance company will help pay to repair any damage.

The lender views your down payment as a buyer’s participation in the purchase, and the higher the down payment is, the less risky it is for the lender. Your down payment is one way mortgage lenders can assess your finances, establish your creditworthiness and verify that you can repay your loan. A down payment proves to a lender that you’re serious about buying a home and willing to invest your money into the property. If you’re buying a house for the first time or you’re looking for your next home, you may be wondering how much money you’ll need for a down payment.

First-time home buyer down payments start at 3%

The Federal Reserve Bank of St. Louis, using Consumer Price Index data from the U.S. Bureau of Labor Statistics, reports that the average monthly cost for electricity, heating and cooling is $311.69 for urban consumers in September 2022. The average water bill will set you back around $83 a month, according to the Environmental Protection Agency.

How To Improve Your Credit Score to Buy a House

Based on this percentage of income, you can determine the home price you can afford, and ultimately how much cash you’ll need to buy a house. In addition to your credit score, lenders also look at your debt-to-income (DTI) ratio when you apply for a mortgage. If you have a lot of debt compared to your monthly income, you might have difficulty getting approved for a loan – so if you can afford it, make some extra debt payments before you apply for a loan. By making larger payments on student loans, medical bills or credit card balances, you can reduce your debt and improve your DTI. Building your budget is one of the most important steps in home buying. The cost of mortgage insurance depends on your loan type, down payment amount, credit score and many other factors, but it can add $100 a month or more to your mortgage payment.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. VA and USDA loans don't require mortgage insurance, but you will pay a one-time funding fee, as described above. Local governments can raise property taxes to cover municipal projects or expenses, so don’t assume yours will hold steady.

This week seems to be starting where last week left off - with three major lenders announcing further hikes in mortgage rates. For most buyers, working with a knowledgeable local real estate agent is invaluable. An agent will be able to guide you through the entire homebuying process with professional expertise.

The down payment is the amount of money you contribute to the home purchase upfront. By increasing the size of your down payment, you can lower the amount of money you need to borrow — which, in turn, lowers your monthly payments over the course of the loan. Lenders like to see larger down payments because they indicate a lower level of risk if you default on the loan.

How much you'll be able to get from an item often takes into account its rarity, condition, whether it reflects a period in time, and if it's got a good name behind it. People will also look out for vintage framed prints by artists such as Tretchikoff, J.H. Lynch and Shabner - these can range in price from £50 upwards to a few hundred pounds plus. Spring is often the most popular time for buying and selling collectibles, with demand spiking in March and April. While my hot pink Gameboy Micro is lost to the void of time (or a cardboard box somewhere in my mum's house), other versions of it are selling on eBay for £100 or more. And potatoes might also see a price hike in the coming months, with growers warning of a major shortage in the autumn due to persistent wet weather.

Your lender will then use the escrow account to pay any property taxes, interest or insurance premiums when they come due. "No closing cost mortgages" exist, but these will cost you more over the life of the loan. Because the closing costs are rolled into the amount of the mortgage, you're borrowing more money — and paying interest on all of it. Bankrate’s home-affordability calculator can help you figure out what salary is needed to afford a $400,000 home. Based on these numbers, your monthly mortgage payment would be around $2,470. The median U.S. home sale price — what buyers actually paid for a property — also hit a record in April, reaching $383,725, Redfin said, with its data going back to 2015.

Mortgage payments include the principal, or the amount you borrowed to buy the home, as well as interest. Buying a house takes a lot of money, especially in major West Coast and northeastern cities. But, there are special mortgages and home buyer assistance programs that could put home ownership within reach. "As interest rates have stabilised and buyers adjust to the new economic reality of owning a home, one way to compensate for higher borrowing costs is to target smaller properties. Flats and terraced houses made up 57% of all homes purchased by first-time buyers last year. And it's smaller homes that have recorded the biggest increases in price growth in the early part of this year - with buyers adjusting their expectations to compensate for higher borrowing costs.

No comments:

Post a Comment