Table Of Content

Here are two top strategies that help people accumulate the funds needed to buy a house. You’ll have a comfortable cushion to cover things like food, entertainment and vacations. The market has been pulled by various forces this month, with hopes of a rebound in demand in China among them. Financial markets currently see two rate cuts by the Bank of England this year.

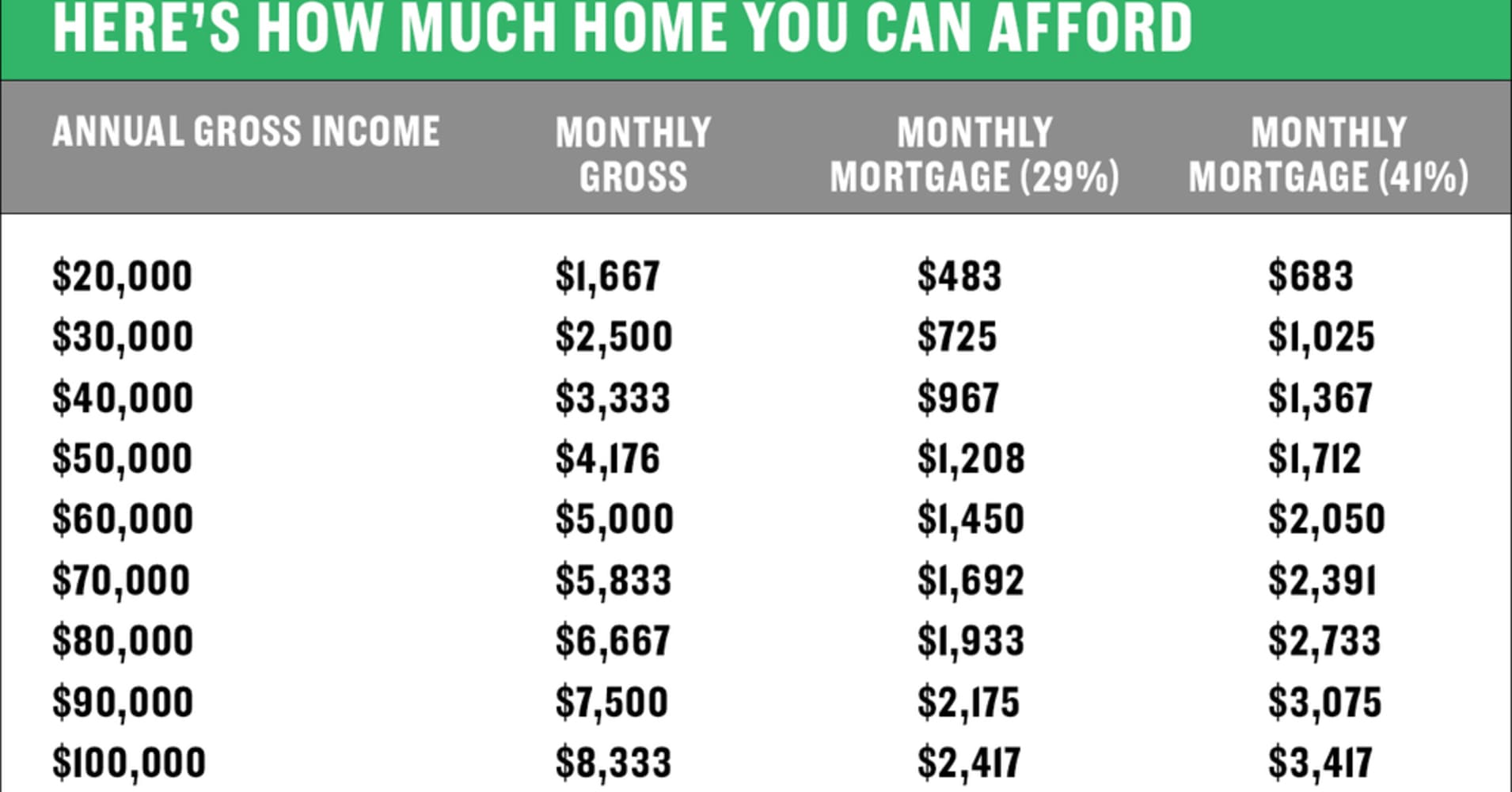

Disputing Errors on Your Credit Report

So that would be the limit of what you should spend on housing — meaning $105,864 is the minimum income you’d need to comfortably afford that $400,000 home purchase. That’s a good bit above the national median home price of $363,000, according to the National Association of Realtors. The income needed to comfortably afford such a purchase will depend on a variety of factors, including, crucially, the interest rate of your mortgage. The average interest rate on a fixed 30-year home loan rose to 7.1%, marking the first time this year rates have topped 7%, according to Freddie Mac. Meanwhile, the median asking price for U.S. home — what homeowners hope their property will sell for — jumped to a record $415,925 for the four weeks ended April 21, Redfin said.

2 rules to consider when deciding how much mortgage you can afford, according to a financial planner - CNBC

2 rules to consider when deciding how much mortgage you can afford, according to a financial planner.

Posted: Thu, 25 Apr 2024 07:00:00 GMT [source]

First-time home buyer down payment assistance programs

Key factors in calculating affordability are 1) your monthly income; 2) cash reserves to cover your down payment and closing costs; 3) your monthly expenses; 4) your credit profile. But the other two loan types, conventional and FHA, are a lot easier to come by. You’ll still need to meet minimum credit score requirements as well as employment and income guidelines, just like any other home loan. But there are no “special” requirements to get a low-down-payment FHA or conventional loan as a first-time home buyer. Ideally buyers would be able to put down at least 20% of the home price to avoid paying private mortgage insurance, but it’s not a requirement.

Using gift funds to cover your down payment

Zhao added, "My advice for serious buyers who can afford today's costs is to shop for your dream home and accept that this year is probably not the time to find a dream deal." They will reach out to you, as well as the company in question, for evidence as needed. If the company or lender can’t prove the information is accurate, they must notify the three major credit bureaus so the error can be removed from your report. Hopefully, this will help your credit overall—and you’ll be ready to embark on your home buying journey. To qualify for a Rural Housing mortgage, you can’t make more than 115% of the local median income (meaning no more than 15% above the median).

While it's true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

What are the Benefits of Homeownership?

Offer valid on primary residence, conventional loan products only. Cost of mortgage insurance premium passed through to client effective January 2, 2024. Offer valid only for home buyers when qualifying income is less than or equal to 80% area median income based on county where property is located.

You can buy a home with no money down if you qualify for a Department of Veterans Affairs (VA) loan or a U.S. VA loans are mortgage loans for current and former military personnel and surviving spouses who meet the VA’s criteria. USDA loans are mortgage loans for homes in qualifying rural and suburban areas.

Bear in mind that the down payment is just one of many home-related expenses. You may want to budget up to 1% of the home’s value for annual maintenance costs. Plus insurance, taxes, and homeowners association fees, if there are any, can also add significantly to the monthly cost of owning a home.

Enough savings for the down payment and closing costs

For a first-time home buyer down payment, you’d need to save around $13,500 to $15,750 to buy a $450,000 home. But if you qualify for down payment assistance, you might need even less. So if saving for the down payment is a challenge, ask your mortgage lender what help is available.

It’s a percentage of the home’s purchase price, and though mortgage lenders once required a 20% down payment, this is no longer the case. Home prices have been on a rollercoaster ride in recent years and are still very high, as are mortgage rates. It’s enough to make you wonder whether now is even a good time to buy a house. It’s important to focus on your personal situation rather than thinking about the overall real estate market. Is your credit score in great shape, and is your overall debt load manageable?

The fees can cost anywhere from a few hundred dollars a year to thousands of dollars a month. On average, the owner of a single-family home pays $200 – $300 a month in HOA fees. But you will when you buy a house and should make a plan to pay your taxes. Since a self-employed borrower’s income can fluctuate from year to year, mortgage lenders often average out their income over a two-year period, and then use this figure for qualifying purposes.